unrealized capital gains tax yellen

Treasury Secretary nominee Janet Yellen reportedly said she would consider taxing unrealized capital gains but billionaire investor Howard Marks said its not a practical. President Biden needs to raise money for his administrations goals and United States Secretary of the Treasury Janet Yellen has an idea.

Janet Yellen Just Proposed A Tax On Unrealized Capital Gains For Those Who Don T Know

Apparently Janet Yellen has been floating the idea of an unrealized capital gains tax.

. For example perhaps you. Speaking on CNNs State of the Union on. For example they could tax all unrealized capital gains less any unrealized capital losses at a low rate say 1 and then reset the cost-basis to be equal to the marked to.

Well I think whats under consideration is a proposal that Senator Wyden and the Senate Finance Committee have been looking at that would impose a tax on unrealized. 36 votes 105 comments. Unrealized capital gains put simply is the increase in the value of an asset that has yet to be sold.

Primarily for accountants and aspiring accountants to learn about and discuss. Not exactly sure how that would work especially if the next year the stock price drops below what you paid. Earlier in 2021 Yellen proposed taxing unrealized capital gains to boost US.

The phrase unrealized capital gains has been trending on social media and forums during the last 24 hours after the US. It looks like Janet Yellen would like to tax unrealized capital gains. It doesnt take a genius to realize how stupid this is and how difficult it would be to actually.

This profit is a capital gain. Secretary of the treasury Janet Yellen discussed. 276k members in the Accounting community.

NEW US. Capital gains tax is a tax on the profit that investors realise on. Treasury Secretary Yellen proposes a tax on unrealized capital gains to finance Bidens Build Back Better plans.

Janet Yellen the Treasury Secretary in the Joe Biden administration has proposed a tax on unrealised capital gains. The exact magnitude of the capital gain is 2000 gross proceeds minus 1000 cost basis resulting in a long term capital gain of 1000. Treasury Secretary Janet Yellen announced on October 23 that a proposed tax on unrealized capital gains yes gains from investments that havent even been sold yet could.

They are willing to annihilate all investor. It is the theoretical profit existent on paper. CapitalGains Tax Cryptohttpsmurderofcrowsiohttpscryptocrowiobitget - LeverageCopy Trade Exchangehttpsupholdsjvioc2060232106153613619Fol.

The fact Janet Yellen is even considering an unrealized capital gains tax perfectly illustrates the monstrous economic crisis were in. The United States Treasury Secretary Janet Yellen has announced the proposal of a new tax that could hit unrealized capital gains. Government coffers during a virtual conference hosted by The New York Times.

Opinion Biden S Latest Tax The Rich Scheme Would Be An Unworkable And Possibly Unconstitutional Mess The Washington Post

Unrealized Capital Gains Tax Stock Bitcoin Bitcoin Magazine Bitcoin News Articles And Expert Insights

Unrealized Capital Gains Tax Stock Bitcoin Bitcoin Magazine Bitcoin News Articles And Expert Insights

Yellen I Will Tax The Peoples Unrealized Capital Gains Whether You Cash Out Or Not Get Your Hard Assets Now Get Perspective On How This Affects You See Links R Wallstreetsilver

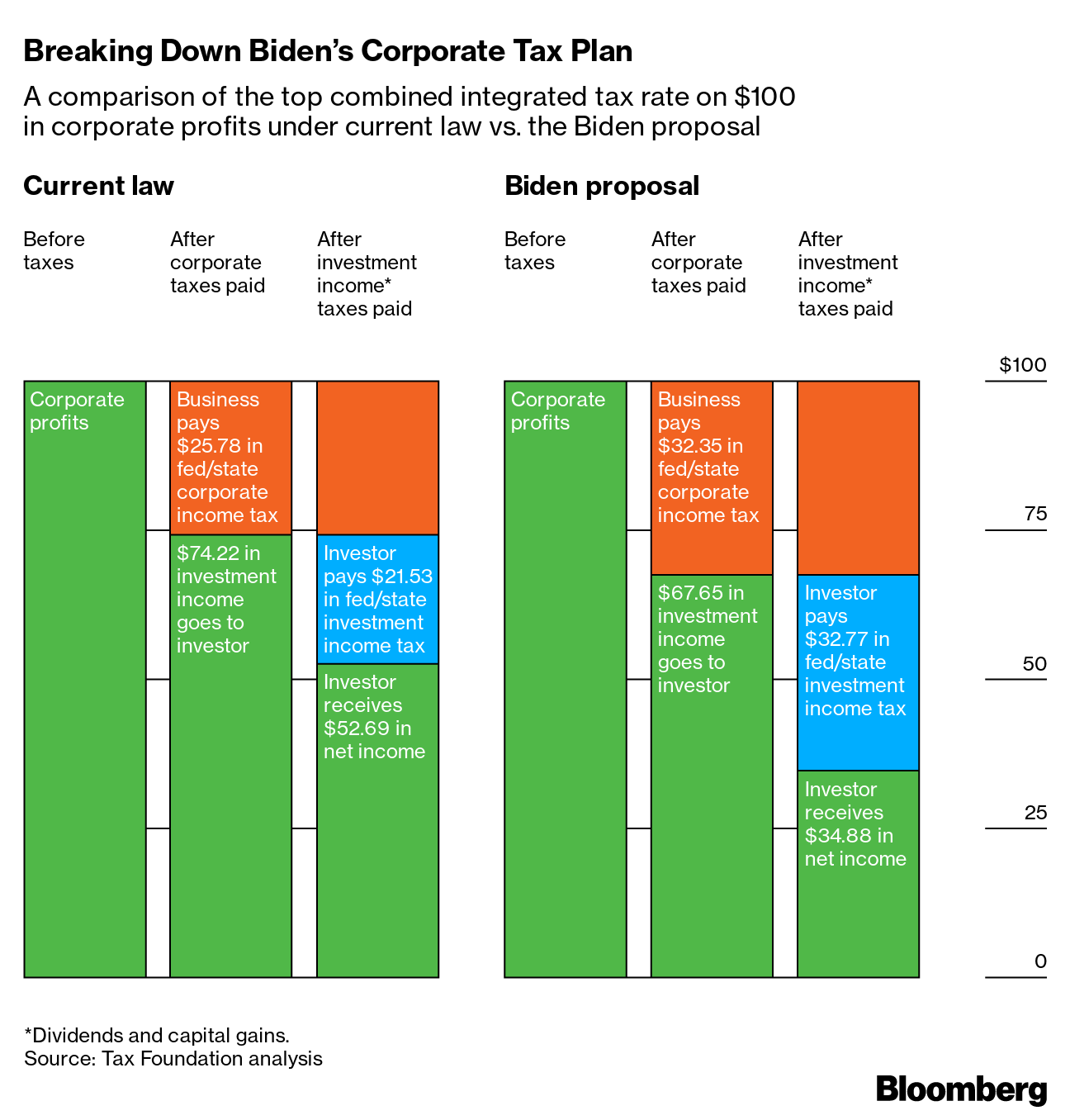

The U S Can T Afford A Tax Policy That Punishes Wealth Bloomberg

Opposed To The Unrealized Capital Gains Tax R Elonmusk

Discover Unrealized Capital Gains S Popular Videos Tiktok

Democrats Terrible Idea Taxing Profits That Don T Exist

Newest Tax Proposal In Washington Won T Impact Most Farmers Today But Tax Expert Warns It Could Be A Trojan Horse For Higher Taxes Agweb

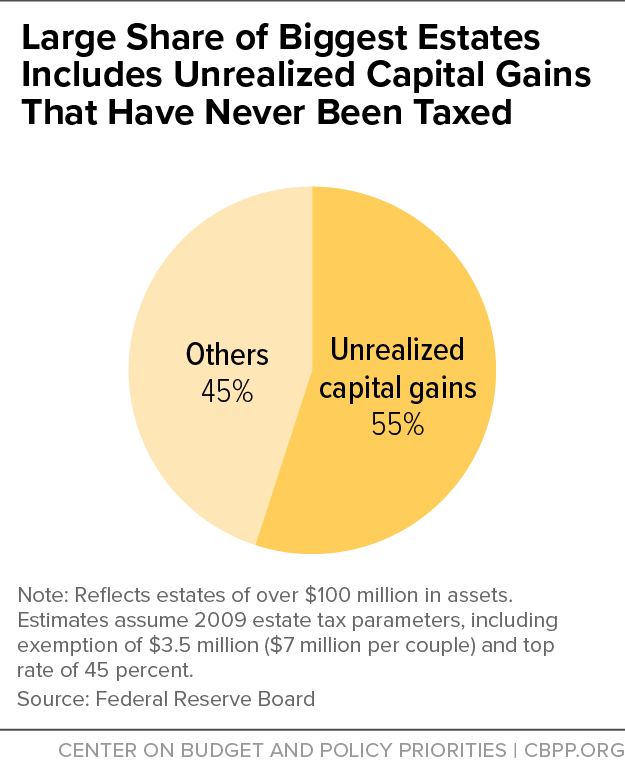

Large Share Of Biggest Estates Includes Unrealized Capital Gains That Have Never Been Taxed Center On Budget And Policy Priorities

The Meaning Of Income Suddenly Becomes Very Important For Tax Purposes Mish Talk Global Economic Trend Analysis

Treasury Secretary Janet Yellen Democrats Considering To Impose A Tax On Unrealized Capital Gains The Daily Wire

Yellen Describes How Proposed Billionaire Tax Would Work Barron S

Dems Plan Billionaires Unrealized Gains Tax To Help Fund 2t Bill

If Biden Raises The Long Term Capital Gains Tax To 39 Does This Mean When I Sell My House I Owe The Government 39 Of The Profit On My House How Can I

Breaking Treasury Secretary Yellen Is Calling For An Unrealized Gains Tax This Is Unconscionable For Those

No U S Won T Tax Your Unrealized Capital Gains Alexandria

Spike Cohen Breaking Treasury Secretary Yellen Is Facebook

Why Congress Shouldn T Rush To Enact Poorly Conceived New Taxes To Fund Spending Spree The Heritage Foundation